3 Dec 2025

Job 4472 wraps up. Invoice goes out. Three weeks later, finance tells you it lost money.

By then, you've already quoted Jobs 4480 through 4485 the same way.

This is how margin disappears. Not dramatically. Just steadily, invisibly, one job at a time.

The Spreadsheet Trap

Most manufacturing SMEs run on a patchwork:

Excel as the system of truth

Clockify or Connecteam for shift time

Paper travellers with scribbled notes as the way of tracking actual times

SharePoint doing things it was never meant to do

Email as the workflow engine

Dave, who somehow knows everything

This exists for one reason. Not because you love chaos.

Because you've been left with bad choices:

Big ERP feels high-risk, high-cost, and slow

Off-the-shelf software doesn't fit how you actually work

Consultancy is priced like you're a mid-market giant

You need answers in weeks, not quarters

So you stitch. You patch. You survive.

Until one big job goes wrong and wipes out the month.

When Guesswork Runs Your Commercial Model

Here's what's actually happening when you quote a job:

Labour rates? Industry average from two years ago.

Efficiency assumptions? Based on when things go well.

Material costs? Last supplier quote, or what you paid last time.

Overhead allocation? Finger in the air.

Quoting cost rate? Just one amalgamated hourly cost rate from a year or two ago

Machine sell rates? Unchanged for years on the back of rising costs

You're not building quotes. You're making educated guesses.

And uncalibrated cost models cause 15-30% margin leakage because:

Labour and burden rates are assumed, not measured

Efficiency expectations go unchallenged for years

Material valuations drift out of date

Process time estimates live in people's heads

Times are estimates that never get validated

The quote looks profitable in the spreadsheet. The invoice goes out. Then reality arrives three weeks later in a finance report you don't fully trust anyway.

By then, the next five jobs are already in progress.

The Real Cost of Being Blind

When you can't see job profitability while the job is running, you get:

Margin leakage you can't stop. Overruns happen. Material waste happens. By the time you know about it, the damage is done.

Quotes built on hope. Your best estimate is last time's numbers. But was the last time actually profitable? You won't know for weeks.

Decisions that stall. "Should we take this job?" turns into a debate instead of a decision, because nobody trusts the data enough to be definitive.

The "Ask Dave" problem. One or two people hold all the operational knowledge. They leave, you're in trouble.

Firefighting, not improving. Your production manager wastes hours every week chasing information instead of fixing problems.

In a world where wages are climbing and customers push back on every price increase, you can't afford to learn profitability in hindsight.

If you're turning over £5m and losing 10% to margin leakage, that's £500k lost contribution.

What Changes When You Can See

Imagine knowing, while a job is running, that you're two hours over on labour.

Not three weeks later. Now. While you can still do something about it.

Job-level profitability in real-time means:

You catch overruns while they're happening, not after they've compounded

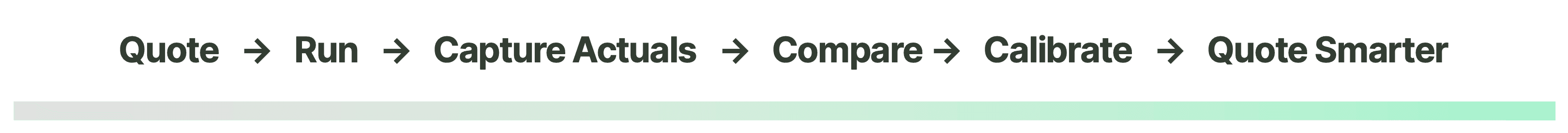

Your cost models calibrate with every job you run

Quotes get smarter because they're built on real data

You stop repeating expensive mistakes

Pricing conversations become confident and objective, not defensive

This isn't about dashboards. It's about knowing which jobs make you money and which ones don't, before you quote the next one.

The Therion Approach: Start Small, Prove Value, Scale Fast

We built Therion for manufacturers stuck between spreadsheets and the ERP wall.

No year-long implementations. No consultancy bloat. No betting the business on unproven software.

How it works:

Discovery (2 weeks): We map your current setup, what systems exist, where data lives, and which pain points bleed the most money. This shapes a focused rollout plan tailored to how you actually work.

Foundation Module (8 weeks): We start with Job Tracking, digital travellers, real-time labour booking, plan vs actual reporting. You replace paper and spreadsheets with live visibility into which jobs are profitable and which aren't.

This first module pays for itself fast: clients typically reclaim 10-15 hours per week from manual reporting and improve job profitability by 5-10%.

Calibration: Your assumed labour rates become measured rates. Your efficiency guesses become data. Every job makes your cost model smarter.

Scale (ongoing): Once the foundation proves itself, you add modules as you're ready: scheduling, quoting, materials, quality. Each one deepens control and compounds the value of the previous one.

No rip-and-replace. You keep what works. You fix what's broken. You build an operating spine that grows with you:

Job profitability you can trust

Cost models that calibrate themselves

Pricing confidence that compounds with every job

Clear visibility without enterprise complexity

Value in weeks, not quarters. Modular expansion, not all-or-nothing risk.

What to Do Next

Pick your five most recent jobs that you thought were profitable.

Now calculate true profitability with actual labour hours, actual material costs, and actual time on the floor.

See the gap? That's what you're working with every time you quote.

We can show you what this looks like in your business, no theory, just your data, your jobs, your reality.

If this is you:

“You only know margin at month-end”

“Quotes rely on tribal knowledge”

“Timesheets are late or guessed”

“Travellers get lost or unreadable”

“Don’t have separate cost rates”

Book a free 60-minute digital audit. We'll show you where margin is leaking and what it would take to plug it.

Read More from Therion: